#

Note 2. List of options

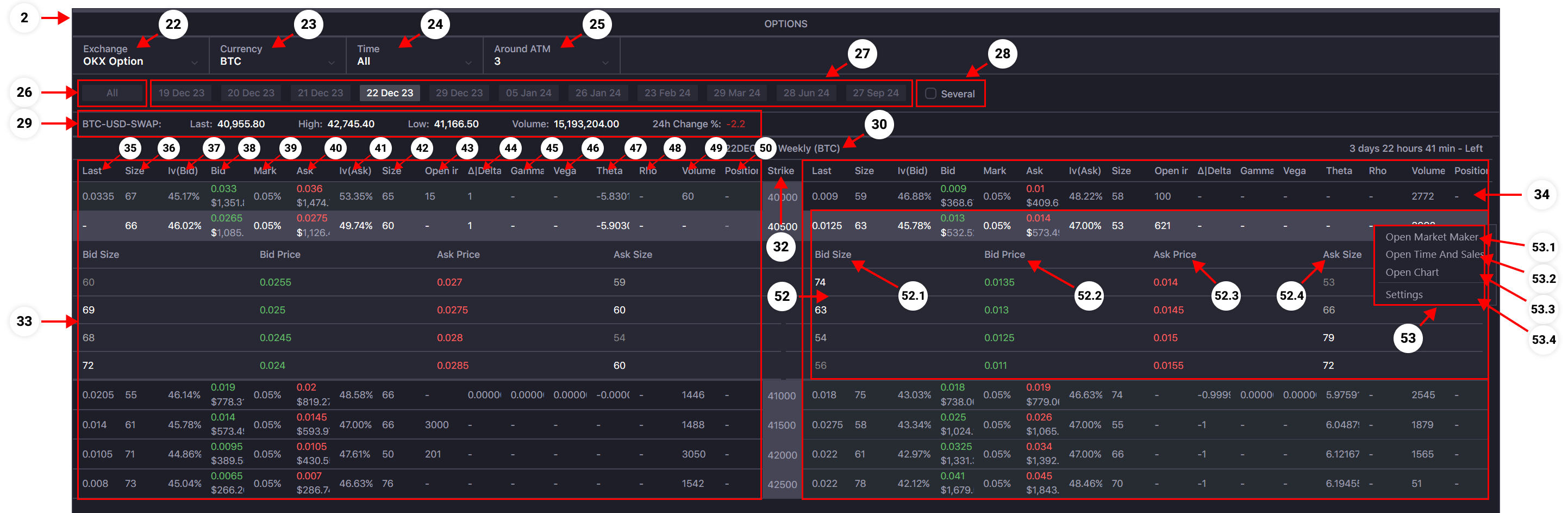

- The exchange filter is available for use in the OptionChain window. Select the desired exchange from the list, and the entire OptionChain window (Assets, Options, OMS/PMS) will switch to display data for options of the selected exchange.

- Underlying asset filter for options on the selected exchange. Select the desired underlying asset, and the Options, PMS, and OMS blocks will display information only for options of the selected underlying asset.

- Options block filter by the option expiration date parameter. Select the required type of options from the list to view market data in the Options block. These can be all types of options by expiration date (ALL), Daily Options, Weekly Options, etc.

- Options block filter that controls the number of displayed strikes in the options list table. The list of strikes is built based on ATM (At The Money), meaning if you select "5", the table will display a list of options with five AtTheMoney strikes and five OutTheMoney strikes.

- Click to set the Options block to display options with all available expiration dates on the selected exchange.

- Expiration date filters block for options. Press one of the buttons to set the Options block to display a list of options only with the selected expiration date.

- CheckBox for advanced settings in the expiration date filter block. Enable to have the ability to display multiple lists of options with different expiration dates in the Options block simultaneously.

- Level 1 Info of the underlying asset for options displayed in the Options block.

- The expiration date and type of options by expiration date are displayed in the table with the list of options.

- A timer that displays the remaining time until the expiration date of the options is shown in the table of selected options.

- A column in the options list table that displays the Strike of selected options. The number of strikes displayed depends on the "Around ATM" filter settings. Click on a selected Strike to view the table of the order books for both the Call option and the Put option with the selected strike.

- Options table block that displays the list of Call Options.

- Options table block that displays the list of Put Options.

- Column in the options list that displays the Last Price of the option contract.

- This is the amount (size) that is on the best bid.

- This is the implied volatility of the best bid price.

- This is the price at which users are willing to buy the option.

- This is an exchange metric to estimate the fair value of the option. All user positions are valued against the Mark Price to calculate equity.

- This is the price at which users are willing to sell the option.

- This is the implied volatility of the best ask price.

- This is the amount (size) that is on the best ask.

- Open Interest is the total amount of outstanding contracts.

- Delta is a risk measure and gives the change in USD(T) price as the underlying changes.

- The change of Delta for every 1 USD(T) change of underlying asset price.

- Vega is a risk measure and gives the USD(T) change in the option price for a 1% change in volatility.

- Theoretical Options price change during a given period (usually a day). Theta is often referred to as the time value of Options contracts.

- Rho is the rate at which the price of the Option changes relative to a change in the risk-free rate of interest.

- The volume in the last 24 hours for this instrument.

- The number of contracts you have for the instrument.

- A row that displays an option in the list of options. The rows are structured according to the list of Strikes. Click the left mouse button on the option row to open the order book for the selected option contract (item 52). Right-click to open a contextual menu for the selected option (item 53).

- Expanded Order Book block for the selected option. For quick order placement for the selected option, double-click on the expanded Order Book and send the order using Quick Order.

- 52.1. Column with Bid Size in the expanded order book.

- 52.2. Column with Bid Price in the expanded order book.

- 52.3. Column with Ask Price in the expanded order book.

- 52.4.Column with Ask Size in the expanded order book.

- Contextual quick action menu for the selected option contract. Right-click on the desired option row in the options table to bring up the menu.

- 53.1. A quick opening of the Market Maker window with the selected trading instrument.

- 53.2. A quick opening of the Time and Sale window, with the selected trading instrument.

- 53.3. A quick opening of the Chart window, with the selected trading instrument.

- 53.4. A quick opening of the Advanced Settings of the Options Chain window (Tab of Options block columns).